Four Reasons For Fed To Act

Even if Powell pushed back on a March rate cut, there are at least four reasons for the Fed to consider both cutting rates and tapering QT.

Hi there! In today’s post I will:

show two reasons the Fed can cut rates and one it may wait a bit longer,

explain two reasons why the Fed needs to start talking about QT tapering now,

comment on the latest Quarterly Refunding Announcement (QRA) and its implications for markets and Fed’s policy.

Markets are pricing in a heavy rate-cutting cycle in the US over the course of 2024. The picture hasn’t changed much in the aftermath of the latest (more hawkish) Fed’s meeting, albeit a date for the first rate cut has been pushed back. Nonetheless, rate cuts aren’t the only game in town for the Fed to remove monetary accommodation. The other option, possibly equally important, is halting the ongoing QT process in which the Fed reduces its balance sheet by $95 billion per month. Powell told us in January that in-depth discussions on this topic would take place in March. That’s understandable given what’s going on in the money market. As always, the final say goes to the Treasury which showed its new QRA having significant implications for various markets. Let’s dig into these issues!

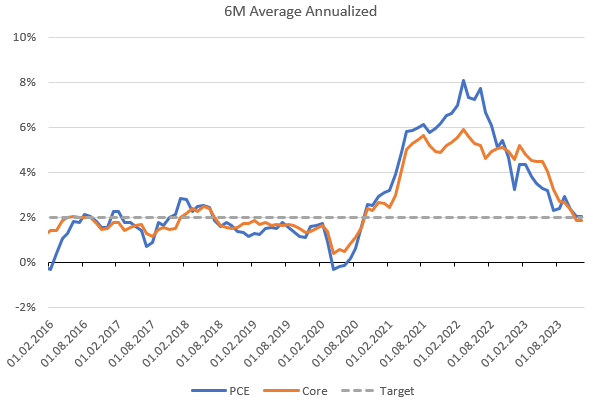

Inflation target reached, some “buts” remain

The first and most visible reason for the Fed to act is the fact that it has basically reached the inflation objective when we look at 6-month annualized averages in both headline and core PCE. As one can notice, both indicators are hovering at around 2%. Hence, from this viewpoint there’s no point in waiting for 2% YoY prints before initiating the rate cuts cycle. However, as Powell stressed during his last press conference, the Fed wants even more confidence that these encouraging inflation releases will be continued. How long can the Fed wait? Nobody knows, probably even the Fed doesn’t exactly know.

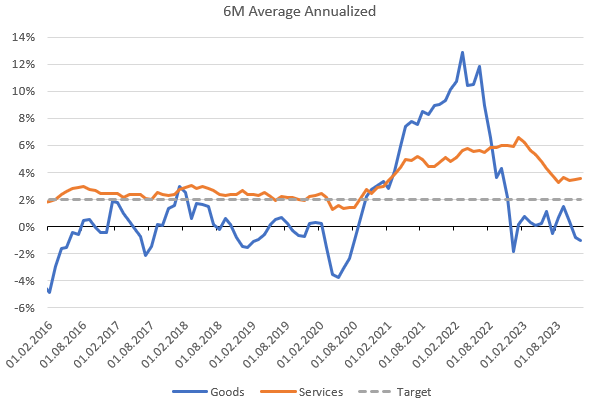

Either way, the Fed has also some arguments to wait longer without worrying about the strength of the real economy. The latest Q4 GDP, coupled with the staggering January payrolls numbers, may easily convince the Fed the economy is still humming. Taking this into account the Fed could refrain from quick rate cuts to avoid possible humiliation once it’s forced to reverse those cuts a bit later due to inflation persistence. What persistence I’m writing about? The answer is simple - services, where inflation momentum is still at around 3.5%.

Is this a problem? It might be because elevated inflation in services keeps fueling wage growth fluctuating at +4%. In the long-term, nominal wage growth should be equal to the inflation target and productivity growth. If the Fed’s goal remains at 2%, then productivity growth would have to rise to +2% to justify the current pace of wage growth. If this happens, it won’t be the problem for the Fed as it’d be able to reach its objective anyway.

How does productivity growth look like? Well, looking at the 4-quarter annualized average one would arrive at a conclusion that the Fed is safe because productivity growth stood at 2.7% as of the end of 2023. However, the Fed needs steady growth at about this pace to accept the wage growth we're seeing these days. Thus, it seems to be better to look at the trend proxied here by the 5Y CAGR which stood at 1.8% at the end of last year. As one can notice, there’s still some job to do in order to enter the orange area justifying wage growth at +4%. Can we go there? It’s definitely possible given the whole AI hype, but the jury is still out. Nevertheless, it’s worth keeping a close eye on it.

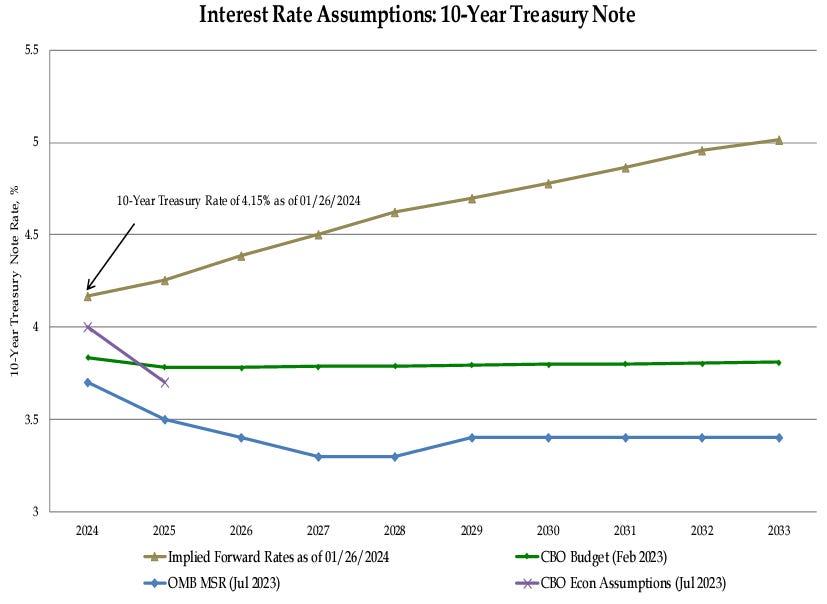

Finally, the start of rate cuts will come to help for the Treasury given the fact that interest payments are soaring on the back of high interest rates and an ever-growing debt load. Here, it’s also worth stressing that the cost of debt servicing is notably understated given the interest rate path assumed. As a result, the budget deficit is likely to grow even higher than the CBO predicts, that’s something the Fed needs to also take into account.

QT tapering is back in the spotlight

During his latest press conference Powell told us that in-depth discussions regarding QT would take place in March. What’s more, he even suggested that there was no need for RRP (the Fed’s reverse repo facility) to go zero before tapering. That’s telling. It means Powell is serious about QT tapering. The timing does matter, but I’m gonna delve into this topic in another post (make sure to subscribe to not miss this analysis).

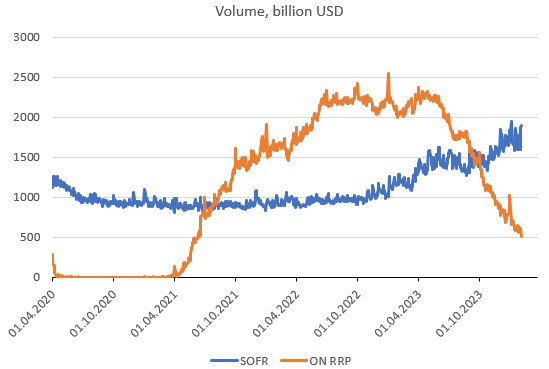

Why does Powell want to begin talking about QT tapering now? The first reason is the money market situation where we’ve seen some nervousness in recent weeks. It can be seen in some spikes in the SOFR-ON RRP spread. In practice, the spread measures where there’s more profitable to invest: the private repo market or just place money at the Fed. The higher the spread, the higher demand for financing in the private repo market. Why is this happening?

Since June 2023, when the Treasury started issuing T-bills en masse, the ON RRP volume began falling like a stone. We went down from $2.3 trillion to roughly $500 billion nowadays. At the same time, there was the growing volume in the private repo market (SOFR) suggesting increased financing needs of leveraged investors. Moreover, an avalanche of freshly issued T-bills was undoubtedly predominantly embraced by money market funds (MMFs) - the largest user of the Fed’s RRP facility - whose assets are keep rising.

In short, the closer to zero we are in the ON RRP, the more nervous markets tend to be. Why? Once the ON RRP is finally emptied, the QT’s impact on USD liquidity will be strengthened. Until then, it’s remarkably important for the Fed to remove the discount window stigma and thereby persuade market participants to tap the facility if needed.

There’s one more reason to start talking about QT tapering. The chart below presents it quite well. Namely, the unrealized losses of US banks haven’t decreased so far. Of course, those interested in increasing their cash position might always borrow from the Fed under the BTFP (though the conditions changed), but the facility will expire next month. With this in mind and considering the shrinking USD liquidity on the horizon some banks might be in trouble again. The backdrop would look better once their unrealized losses are lower and thereby they’re able to borrow more against Treasuries. Meanwhile, the atmosphere around US banks has become more tense of late1.

Key takeaways from new QRA

The Treasury announced its current estimates of net marketable borrowing for this and subsequent quarter of 2024. As it turned out, during Q1, the Treasury expects to borrow $760 billion, down $55 billion compared to the announcement made in October 2023. In turn, it anticipates to borrow $202 billion in Q2. These estimates assume that the Treasury General Account will stand at $750 billion at the end of Q1 and Q2. However, much more interesting is the distribution of net borrowing needs across the yield curve.

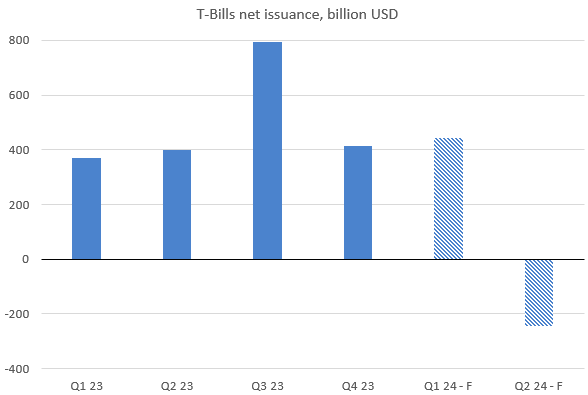

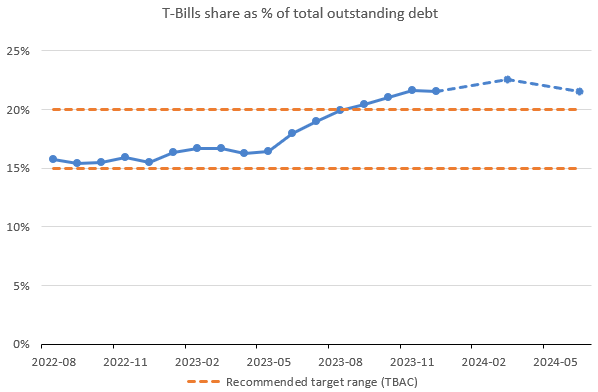

Namely, the Treasury sees a lower amount of T-bills to be issued in Q1, and a higher amount of coupons, though the latter is still lower than expected. On top of that, it also sees a negative net issuance of T-bills in Q2. It means that a share of T-bills in outstanding debt is likely to start returning toward its 15-20% range recommended by the Treasury Borrowing Advisory Committee (TBAC). Albeit, I’m not so sure we’ll be back there anytime soon.

At this place it’s very important to note that the Treasury helped draw down the ON RRP volume by resorting to T-bills instead of coupons. If the opposite had been the case, the ongoing Fed’s QT would have decreased reserves in a much more meaningful way. So it was the Treasury, not the Fed, that decided which source of liquidity the QT process would hit. Whare are possible market implications going forward?

In its statement the Treasury said:

Based on current projected borrowing needs, Treasury does not anticipate needing to make any further increases in nominal coupon or floating-rate note auction sizes, beyond those being announced today, for at least the next several quarters.

On top of that, the Treasury said that it would announce the start-date for its new buyback program in the May refunding statement. Keep in mind that the program is going to help in cash management and also improve liquidity of off-the-run Treasury securities. All in all, I find the January QRA quite supportive of longer tenors.

What does the QRA mean for money market rates and Fed’s policy respectively? Well, less T-bill issuance means less pressure on short-term rates to move higher. Therefore, I think that money market rates could stabilize for some time before showing new signs of stress later in the year.

In terms of Fed’s policy, less T-bill issuance should probably slow down the ON RRP drawdown, at least to some extent, and thereby allow the Fed to keep the full-pace QT somewhat longer. Going forward, the ON RRP volume ought to keep declining toward zero irrespective of which particular tenor the Treasury opts to issue. Why?

More T-bill issuance means that money is directly taken out of the RRP to T-bills by MMFs as they’re trying to lock in a higher interest rate anticipating rates cuts in the coming months.

More coupons issuance means a growing demand to finance newly issued securities in an environment in which USD liquidity is expected to shrink. If so, the private repo rates should increase high enough to encourage MMFs to direct money from the ON RRP back to the banking system (the private repo market), albeit it could take more time (there are also limits on bank balance sheets to finance all of those needs). That’s something we’ve been experiencing lately as evidenced by the swelling SOFR volume.

So, when will the Fed start QT tapering? That’s the topic I’m gonna cover in the next post.

Did you enjoy the piece? Please share this post and help me reach out to an ever-growing audience.

Do you have any thoughts or want to share your view?

https://www.bloomberg.com/news/articles/2024-01-31/new-york-community-bancorp-slumps-on-surprise-loss-dividend-cut